Mineral Resources and Reserves Disclosure Code Standards

Disclosure or technical mineral reporting codes for resources and reserves serve as minimum standards for good professional practice for publicly reporting mineral property assets in the form of Exploration Results and Mineral Resources and Mineral Reserves. The mineral reporting codes lay a framework for resource and reserve classification following the depth of confidence in the geological knowledge, metallurgical recovery amenability, and the economic feasibility of mineral properties.

Public Disclosure of Mineral Resources and Reserves

Advantages to the Mining Company, Publicly or Privately Held

Whether if a mining company is publicly held and listed or privately held, reporting mineral properties on a technical standard is valuable regardless of regulatory requirements. Though public reporting standards may often not be required for privately held mining companies, private companies can still find that following a technical reporting standard still has its gains.

Adopting a technical reporting standard for mineral holdings regularizes and improves the evaluation process of mining properties not only within the company but in dealings with other entities like financial institutions, governments, and other mining companies. Particularly, the standardization of evaluation facilitates and enhances intercompany activities such as capital and asset allocation between potential projects, mine capital financing, regulatory compliance; as well as acquisition, merger, and sale of mining properties.

Specifically, financiers and financial institutions like banks or private equity regularly require that for mine financing that the mineral holding is reported in a “Bankable Feasibility Study” format following a regionally accepted technical standard completed by technically competent persons. In mergers and acquisitions technical documents are often relied upon for confirming the state of the mineral project and conducting negotiations regardless of buyer or seller status.

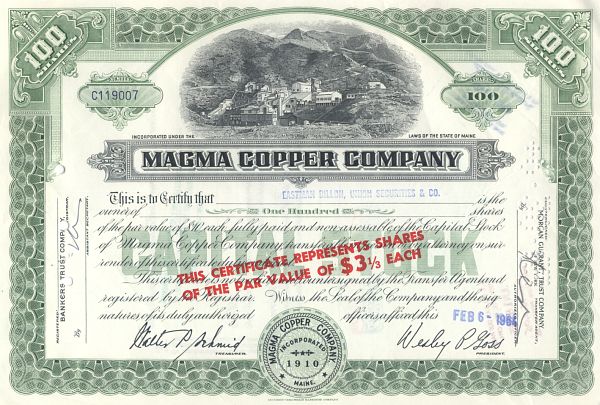

Magma Copper Company Stock Certificate,

Magma Copper Company Stock Certificate,Now owned by BHP Billiton

It should be noted that these technical documents should be completed by competent persons as the document will likely be reviewed in due diligence by other entities with their own competent persons. It is important that the technical document for the mineral property can hold up to due diligence with regards to but not limited to the depth and quality of knowledge of the geology, metallurgy, and the economic viability, and overall feasibility of the project. Refer to here for information on this.

Furthermore, on a technical basis companies reporting mineral holdings on a standard will find that these reports assemble a complete overview of necessary technical information about the project for improved project management. Enhanced project direction is realized through better risk-controlled mine property development from exploration to production, standardized mine project evaluation for company opportunity analysis, and early identification of critical flaws.

CRIRSCO and the National Reporting Organizations

Currently, there are number of technical reporting code standards that can be uniquely applicable to mineral holdings depending on the circumstances inherent in the complexity of intercompany dealings. For example, the country and/or the listing exchange may require a specific code, more traditional financiers like banks may request a specific format per internal compliance, or venture partners may also have a format they adhere to.

Listed below is a list today’s technical mineral standards in rough order of their usage in the industry:

- Canadian NI 43-101 Guidelines in Regulation per Canadian Law

- Australian JORC Code in Regulation per Australian & New Zealand Law

- United States Security and Exchange Commission (SEC 10-K) Industry Guide 7 in Regulation per US Law

- In October 2018 the SEC has adopted the SME Guidelines in the format of S-K 1300

- South African SAMREC Code

- European PERC Reporting Code

- Chilean National Committee

- Russian NAEN Code

- Indonesian KOMPERS

- Brazilian CBRR Guide

- Mongolian MPIGM

- Kazakhstan KAZRC

Our team of experienced competent persons at Independent Mining Consultants can provide your company with the valuable independent project advice to develop a sound, efficient plan of project execution for your company’s feasibility study.

IMC provides the following services:

On October 31, 2018, the Securities and Exchange Commission (“SEC” or “Commission”) adopted S-K 1300 amendments to modernize the property disclosure requirements for mining registrants, and related guidance, which are currently set forth in Item 102 of Regulation S-K under the Securities Act of 1933 (“Securities Act”) and the Securities Exchange Act of 1934 (“Exchange Act”) and in Industry Guide 7. The new S-K 1300 amendments are intended to provide investors with a more comprehensive understanding of a registrant’s mining properties, which should help them make more informed investment decisions. The amendments also will more closely align the Commission’s disclosure requirements and policies for mining properties with current industry and global regulatory practices and standards, as embodied by the Committee for Reserves International Reporting Standards (“CRIRSCO”).

As listed previously there are a number of technical reporting standards but many of the standards and their regulatory national reporting organizations do follow the basic international standard guidelines set out by CRIRSCO or the Committee for Mineral Reserves International Reporting Standards. Generally, each regulatory national reporting organization that is a member of CRIRSCO will include the guidelines set out in the CRIRSCO standard but with adaptions tailored their regulatory domains.

Competent Persons Requirements for the Resource and Reserve Codes

Mutually common between all of the reporting codes, the publication of the technical report requires the consent or voucher of competent persons that information displayed in the report is fairly, accurately, and completely represented for their field of expertise. The definition of what is a technically qualified person for the technical document varies some between each of the organizations, but they are typically qualified by mining or geology specific professional organizations that have been accepted as proficiently equivalent by the regulatory national reporting organization responsible for the reporting code standard.

The competent or qualified persons must be a certified professional with the organization managing the code in question. A certified professional at the minimum requires a certain degree of mining industry experience, relevant experience to the subject matter of the technical report, and has recognized mining industry standing recognizable to the governing organization.

Competent persons providing consents for the technical report must declare potential conflicts of interest with regards to the success of mineral property of subject. Usually, this brings value in contracting with independent third party competent persons who can with their consent of the marketability of the project build confidence in the feasibility of the project. For the contracting company this could potentially add value via the new prospective that independent qualified persons can provide.

What Auditors Expect and How We Can Help

Beyond simply having a number of qualified persons giving consent for the technical report it is important that the report will pass any due diligence conducted on the report by auditors employed by the transacting parties. Here it is valuable to have a team of competent individuals that have recognized reputation and seasoned experience that also can assist with providing insightful comments during the development of the project for commercialization. Banks and financiers expect to see strong teams of experts with proven track records of building good producing mines.

Indpendent Mining Consultants, Inc. and partner companies ensure your mining venture fares successfully, has all the potential hurdles accounted and mitigated for, and is brought into production with smooth sailing through financing, construction, operation, and closure. We are qualified to be competent / qualified persons for many of the regulatory bodies. We are proud to have worked with more than 250+ different clients on over 500+ projects and look at meeting more of the wonderful professionals we come to know and enjoy working with.

Learn more about our personnel here!

Learn more about our personnel here!

How we can help is unique to our company’s undenible experience throughout the years, our parterships with local mining industry experts first-class in their specialties, and our region’s ongoing and long history of development of mining techniques and technologies. Arizona, USA is the top copper producing state in the United States and has been producing copper from the 19th century – Arizona was the first to pioneer mining technologies such as leaching and block caving. Tucson, Arizona is home to companies like Caterpillar’s Tucson Mining Center and Cat Proving Grounds, Hexagon’s Mining (MineSight planning software) division, Modular Mining (the dispatch fleet management system), and a number of copper mines owned by Asarco / Grupo Mexico and Freeport McMoRan.